Today, we will understand what Gross Debt Service or GDS Ratio is and how to calculate the GDS Ratio in a mortgage application for a real estate property.

If you have ever applied for a Mortgage or have come across a Mortgage Professional, you must have heard of 2 main ratios – Gross Debt Service or GDS Ratio & Total Debt Service or TDS Ratio. Mortgage professionals use these 2 ratios to determine if borrowers can afford to pay off the mortgage for a specific real estate property that they are dealing with. GDS Ratio is thus, an essential indicator of mortgage affordability and approval.

If you are planning to become a Mortgage Professional, you need to understand what GDS and TDS are and how to calculate these ratios. For now, let’s understand the concept and calculation of GDS Ratio step-by-step.

First of all, let’s understand what are Debt Service Ratios?

So, what are Debt Service Ratios?

Debt Service Ratio (DSR) or Debt Service Coverage Ratio (DSCR) is used in the calculation of mortgage approval for a real estate property. It is a popular benchmark used in the measurement of an entity’s ability to produce enough cash to cover its debt payments, including repayment of principal and interest (on the mortgage) on both short-term and long-term debt. This ratio is often used when the entity applying for a mortgage has any borrowings on its account such as bonds, loans, or lines of credit.

It is also a commonly used ratio in a leveraged buyout transaction, to evaluate the debt capacity of the target company, along with other credit metrics such as total debt/EBITDA multiple, net debt/EBITDA multiple, interest coverage ratio, and fixed charge coverage ratio.

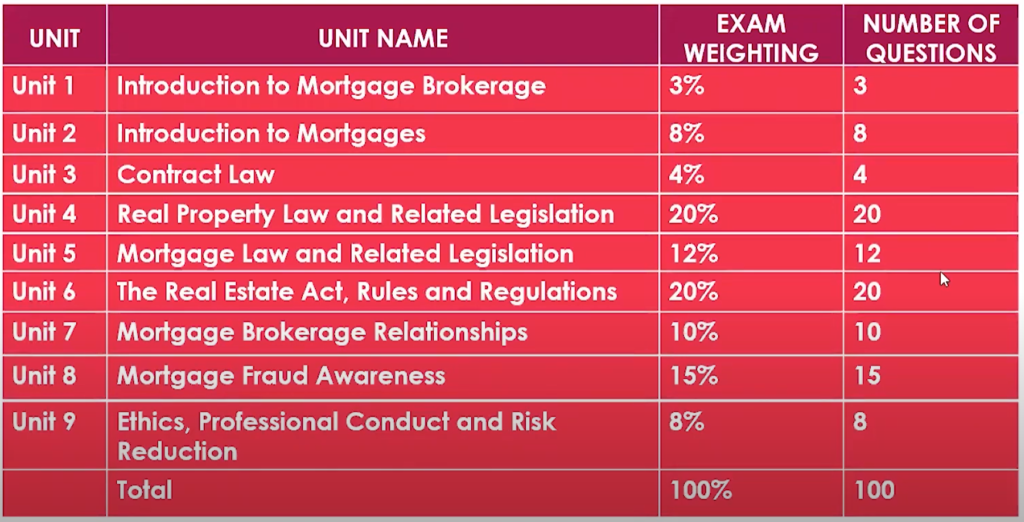

Thus, as we understood, there are 2 types of Debt Service Ratios:

- GDS (Gross Debt Service) Ratio

- TDS (Total Debt Service) Ratio

What is GDS Ratio?

GDS refers to Gross Debt Service Ratio. As we understood, it helps us determine whether a person or an entity is eligible for the intended amount of mortgage or not. GDS is the percentage of your monthly household income that covers your housing costs and not any other debts (unlike TDS).

Factors affecting GDS Ratio

The factors that affect GDS Ratio include:

- Principle Amount (P)

- Interest Rate (I)

- Taxes on the Property (T)

- Heating Costs (H)

- 50% Condominium Fees (If the property is a Condominium)

GDS Formula:

Now, let’s understand the calculation of GDS Ratio with some examples.

Sample Questions

Example 1

Jen and Jason Smith wish to purchase a house subject to financing. Their combined yearly gross income is $84,000. Their monthly mortgage payment is $1,250.75 which includes principal and interest. Their property taxes are $1800.00 for the year and the monthly heating costs are estimated at $100.00. Would the Smiths qualify for the mortgage?

The Variables are:

- Gross Household Monthly Income: $84,000/year = 84000/12 = $7000/month

- Mortgage Installment (Principal + Interest): $1,250.75/month

- Property Tax: $1800/year = 1800/12 = $150/month

- Heating Cost: $100/month

Calculation:

- Step 1: Total Monthly Housing Expenses = PITH = $1250.75 + $150 + $100 = $1500.75

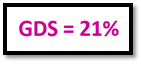

- Step 2: GDS = PITH / Gross Monthly Income = 1500.75 / 7000 = 0.21

In this example, the GDS Ratio is less than 39%. Therefore, the couple qualifies for the mortgage when applying the GDS Calculation.

Example 2

Carol is interested in purchasing a condominium property as an investment. She is an investment banker and her income is $120,000 per year. Carol’s monthly payment for the mortgage is $1,050 including principal and interest. The property taxes for the condo are $1200 for the year. Her monthly condominium fees are $200 per month. The monthly heating costs are estimated at $75.00 per month. Would Carol qualify for the mortgage?

The Variables are:

- Gross Household Monthly Income: $120,000/year = 120,000/12 = $10,000/month

- Mortgage Installment (Principal + Interest): $1,050.00/month

- Property Tax: $1200/year = 1200/12 = $100/month

- Heating Cost: $200/month

- Condo Fees: $75.00/month

Calculation:

- Step 1: Total Monthly Housing Expenses = PITH = $1050 + $100 + $75 + $100 = $1,325.00

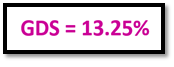

- Step 2: GDS = PITH / Gross Monthly Income = $1325.00 / 10,000 = 0.1325

In this example, the GDS Ratio is less than 39%. Therefore, the couple qualifies for the mortgage when applying the GDS Calculation.

So, this was GDS Calculation for you guys. Stick around for more of such calculations and mortgage related topics.

We also have other important videos including where we share a glimpse of our Training Sessions. One of them is – How to Calculate Vacancy Rate and Occupancy Rate. Check it out here!

Get our Focused Study Guides, Exclusive Video Courses and “In-demand” Tutoring Sessions to get you through the Real Estate Exams on the first attempt!

Get in touch with at 587.936.7779 or support@albertarealestateschool.com.

Happy Studying!